Grosvenor Casino Profit Warning

James Fisher & Sons PLC (LON:FSJ) shares were one of the biggest fallers afternoon trading on Friday after the marine service provider semaphored a profit warning.

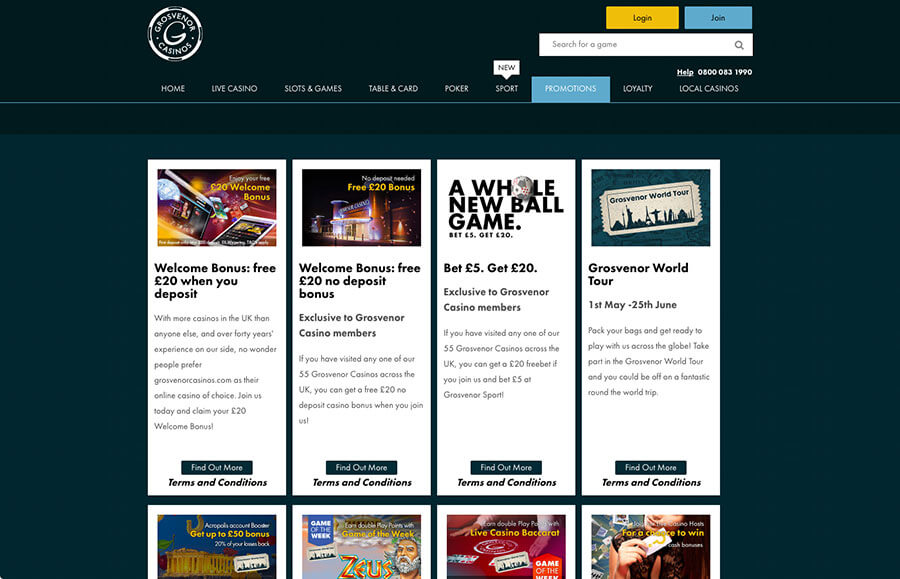

Annual profits for the Rank Group, which includes Mecca Bingo and Grosvenor Casinos, dropped by 66 per cent in the year to the end of June. “Investors have been betting against Grosvenor Casino and Mecca Bingo operator Rank Group since its profit warning in April and that seems unlikely to change after the final results today. The owner of Mecca bingo clubs and Grosvenor Casinos has issued a profits warning after visitor numbers fell due to poor weather and low consumer confidence.Rank Group, the listed gambling company. One of his luckiest sessions came one December, when Green took a trip to a Mayfair casino. A few hours later, Green had pocketed a mind-boggling £2 million – an amount large enough to trigger a profit warning at the casino. Rank Group Grosvenor Casinos registered a 6.1% drop in revenue for the financial year 2017/2018 that ended on 30th of June. The firm blamed the regulations requiring strict checking of customers as having caused a decline in the number of casino customers. The company is, however, determined to forge forward and increase its profit margin.

The FTSE 250-listed group said it had not seen the improvement in trading and usual seasonal uplift in the third quarter that it had been hoping for, with the Marine Support division hit by ongoing project delays and cancellations in subsea projects from clients both the renewables and oil & gas sector.

Management guided to underlying profit (EBITA) of £35-40mln, compared to a consensus of just under £49mln.

11.37am: Takeover action drives big movers on Friday

Two of the top risers on Friday morning are from takeover bids, with property developer Urban & Civic PLC (LON:UANC) agreeing to a cash offer but football pools operator Sportech plc (LON:SPO) rejecting two bid approaches.

Grosvenor Casino Profit Warning 2019

Sportech, which runs Littlewoods and Zetters games including spot the ball and online poker, said it believed the approaches pitched at 25p and 28.5p a share from New York hedge fund Standard General “fundamentally undervalue its businesses and prospects”. Sportech shares, which have fallen from around 50p two years ago to below 20p this year, were up 35% to 28p in late morning trading.

Meanwhile, Urban & Civic agreed to a cash offer from the trustee of the Wellcome Trust that values the property developer at £506.0mln.

U&C shareholders will be entitled to receive 345p in cash for each of their shares, a 63.5% premium to Thursday's closing price of 211p and a full recognition of the company’s EPRA NAV of 343.2p per share as of September 30.

Grosvenor Casino Profit Warning Signs

The real estate investor, which was created from reversing a private equity-backed business into quoted property group Terrace Hill with management led by the former team behind Chelsfield PLC, was focused on a successful strategic land model where plots were sold off in optimum parcel sizes to housebuilders ready for construction.

This follows a £7.2bn potential offer for FTSE 100 group RSA Insurance Group PLC (LON:RSA) that was confirmed overnight, after the shares had already leapt up from 452p to 670p as details leaked out.

The board of the insurer said it would be minded to recommend the proposal from Canada’s Intact Financial and Danish peer Tryg if it leads to an offer being made.

Talks have been going on since early last month and due diligence is currently underway.

10.24am: Beowulf slides on heavily discounted cash call

Beowulf Mining PLC (LON:BEM) shares fell on Friday as the Sweden, Finland and Kosovo focused company launched an open offer to raise up to £7.3mln at 3.16p, a hefty 42% discount to its last closing price.

The AIM-listed company said the extra cash is intended, “first and foremost, to further develop the company's projects”, though more than a third is intended to repay a bridge loan and a quarter will be held for ‘working capital’.

If the Swedish government approves an exploitation concession for Beowulf’s Kallak North, which the company has been doggedly developing since 2006, the funding will enable a scoping study to be completed within 12 months, along with planning for a pre-feasibility study.

Kosovo, where Beowulf has invested in a company to help fund a geophysics programme, while in Finland the new funds would enable a scoping study for the Aitolampi flake graphite project.

8.57am: Empire sparkles on Eclipse gold finds

Empire Metals Ltd (LON:EEE) shares marched 22% higher to 5.3p in early trading on Friday as the Aussie miner revealed encouraging drilling results that would supports extensions to a previously worked gold vein.

Reverse circulation drilling results at the Eclipse gold project, near Kalgoorlie in Western Australia, included three metres at 21.96 grammes of gold per tonne and 8m at 3.2 grammes per tonne.

in a statement, Empire's chief executive Mike Struthers, said: “The geological interpretation of the Eclipse mineralisation is still in its early stages, and the company continues to interpret the data as it becomes available.”

Elsewhere, casino operator Rank Group PLC (LON:RNK) saw its shares recoup a few chips, up 6% to 91.6p, after it confirmed that it has raised £70mln to shore up its balance sheet during the new coronavirus lockdown.

The Grosvenor casino and Mecca bingo owner said it had placed almost 77mln shares at a price of 90p and raised another £1mln from retail investors via the PrimaryBid platform.

Yesterday morning the group said it was mulling a fundraising to help strengthen its balance sheet in the unprecedented trading environment, but that no decision had been made on whether it would go ahead, before announcing just after the market closed that the 19.9% share issue would proceed.

Proactive news headlines:

European Metals Holdings Limited (LON:EMH) (ASX:EMH) (FRA:E861.F) (OTCPINK:EMHLF) has announced that due to increasing interest in its Cinovec project, the largest hard rock lithium deposit in Europe, the company will pursue a US-based OTCQX listing and has commenced trading on the OTC Pink Market. The group said its entry to the US-based OTC markets - and in particular the actively-traded OTCQX market - increases the ease with which North American investors can purchase European Metals securities. The ASX will continue to be the company's primary listing, it added, with investors able to purchase shares through the OTCQX, OTC Pink, UK-based AIM market and Germany's Frankfurt Börse.

Grosvenor Casino Profit Warning Template

US Oil & Gas PLC (PRIVATE:USOP), the oil and gas exploration company with assets in Nevada, said it has raised gross proceeds of around $102,216 from a share placing with private investors. The company said it placed 245,669 new ordinary shares of .0001 Euro each at a placing price of 32p per share including a share premium of 0.3399 Euro on each placing share. US Oil & Gas said the proceeds of the placing will be used to provide the group with additional working capital, including the funding of drilling operations.

Remote Monitored Systems PLC (LON:RMS) said it has been notified that Paul Ryan, non-executive chairman of the company, has elected to convert his entire Convertible Loan Note (CLN) which was issued on July 24, 2020, into ordinary shares. The CLN was for a principal amount of £35,334, has a conversion price of 0.28p and a 6% payment in kind coupon. Accordingly, Ryan will be issued with 12,824,042 ordinary shares in the company in full settlement of the loan and associated interest. At the same time, it added, Ryan has exercised warrants associated with the CLN representing 12,618,928 ordinary shares in the company, at 0.28p per warrant and has also sold 12,821,995 ordinary shares in the company. Following these transactions, the group said, Ryan's shareholding in the company will increase to 67,593,249 shares, representing 4.41% of the enlarged issued share capital and total voting rights of the company.

Landore Resources Limited (LON:LND) announced that it has received a notice to exercise warrants over a total of 533,223 ordinary shares at an exercise price of 2p each, for which funds of £106,644.60 have been received by the company. The exercised warrants were issued as part of the fundraising announced on June 29, 2020.

Ariana Resources PLC (LON:AAU), the AIM-listed exploration and development company operating in Europe, said it has been informed that on November 5, 2020, its chairman, Michael de Villiers disposed of 400,000 ordinary shares in the company at a price of 4.8652p per share, and, on the same date, Mrs de Villiers, his wife, purchased 403,858 ordinary shares in her SIPP at 4.98p per share. Accordingly, the holding of de Villiers now stands at 55,803,000 ordinary shares in the company, representing a holding of 5.22% of the group’s enlarged share capital.

Naked Wines Plc (LON:WINE) has said it intends to announce half-year results for the 26 weeks ended September 28, 2020, on Thursday, November 19, 2020.